In case of an item with a price before tax of 100 and a sales tax rate of 5 this tool will return the following results. Cost of goods sold is determined as the amount of purchases less the change in inventory.

Apply Percents Distance Learning Middle School Math Resources Collaborative Learning Activities Distance Learning

You may find that your example of a playbill is unique and rare but there arent too many people actively collecting such items.

. Sales Tax Sales Tax rate Sale Price In our example we found the Sale Price to be 1721 and we will use a Sales Tax rate of 5. Multiply number of items at list price by list price. Which best describes the function that represents the situation.

If food cost percent is 328 then cost per dollar sale equals. The final cost of a sale item is determined by multiplying the price on the tag by 75. Inventory purchases are debited to a Purchases account.

If sales tax is 105 what is the final price of the shorts with all discounts and taxes. If you buy 4 boxes of cereal how much money will you have to pay at the register. Today it is on sale for 25 off.

5 005 Sales Tax 005 1721 08605 086 Lastly the Total Cost Sale Price Sales Tax Therefore the total cost of the blue shirt is 1721 086 1807. The answer cannot be determined from the given information If opening inventory is 4000 cost of food sold is 20000 and food sales are 80000 then inventory turnover rate is. In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return these results.

Costs of all items are averaged so an average cost is used both for computing the cost of goods sold and the inventory remaining on the balance sheet. The final cost of a sale item is determined by multiplying the price on the tag by 75. The final cost of a sale item is determined by multiplying the price on the tag by 75.

You decide to buy a new sofa for 2540 a coffee table for 629 and a club chair for 1 845. You are paying 60 and youll get 4 items. The final cost of a sale item is determined by multiplying the price on the tag by 75.

There is no sales tax on the cereal. Cost of goods sold is recorded with each sale. You may also get your item if it is particularly valuable appraised.

Multiply the final price by 100. That meal period the restaurant served 275 customers. Splendid Burgers restaurant had monthly purchases of 20000 in March.

Determine the final cost of an Item including sales tax and discounts Question Max bought a pair of shorts on sale for 20 off the original price of 60 and another 25 off the discounted price. Convert the 5 to a decimal. Which best describes the function that represents the situation.

It is linear because the ratio of the change in the final cost compared to the rate of change in the price tag is constant. A It is linear because the ratio of the change in the final cost compared to the rate of change in the price tag is constant. For example if the sale price of an item is 200 and it was discounted by 30 percent then.

Which best describes the function that r. Divide by the percentage in Step One. The most recent purchases are the first to be sold recorded as cost of goods sold so the oldest costs remain on the balance sheet as inventory.

This usually costs a minimum of 20 50 however so do this only as a last resort. Answered expert verified. 100 - 30 70 200 100 20000 20000 70 28571.

It is linear because the function is continuous. Determine the Final Cost of an Item Including Sales Tax and Discounts Question Bobs Furniture Barn is having a sale on all their inventory for Labor Day. The average food cost per customer for that meal period would be.

A box of cereal normally costs 456. Total CostPrice including ST. Which best describes the function that represents the situation.

At the beginning of serve the value of the inventory is determined to be 1200 and at the end of the meal period it is 800. If you purchase anytthing this weekend you do not pay the 9 sales tax on items. Inventory records are not kept for every item.

Regular list price is 20. Determine the final cost of an item Including Sales Tax and Discounts Question The grocery store is having a sale on cereal. Determine if there is a market.

Sale is 4 items for the price of 3. Subtract the discount from 100 to get the percentage of the original price. Round your answer to the nearest cent.

Discounted price per item Number of items at list price x list price Number of items in discount deal. Provide your answer below.

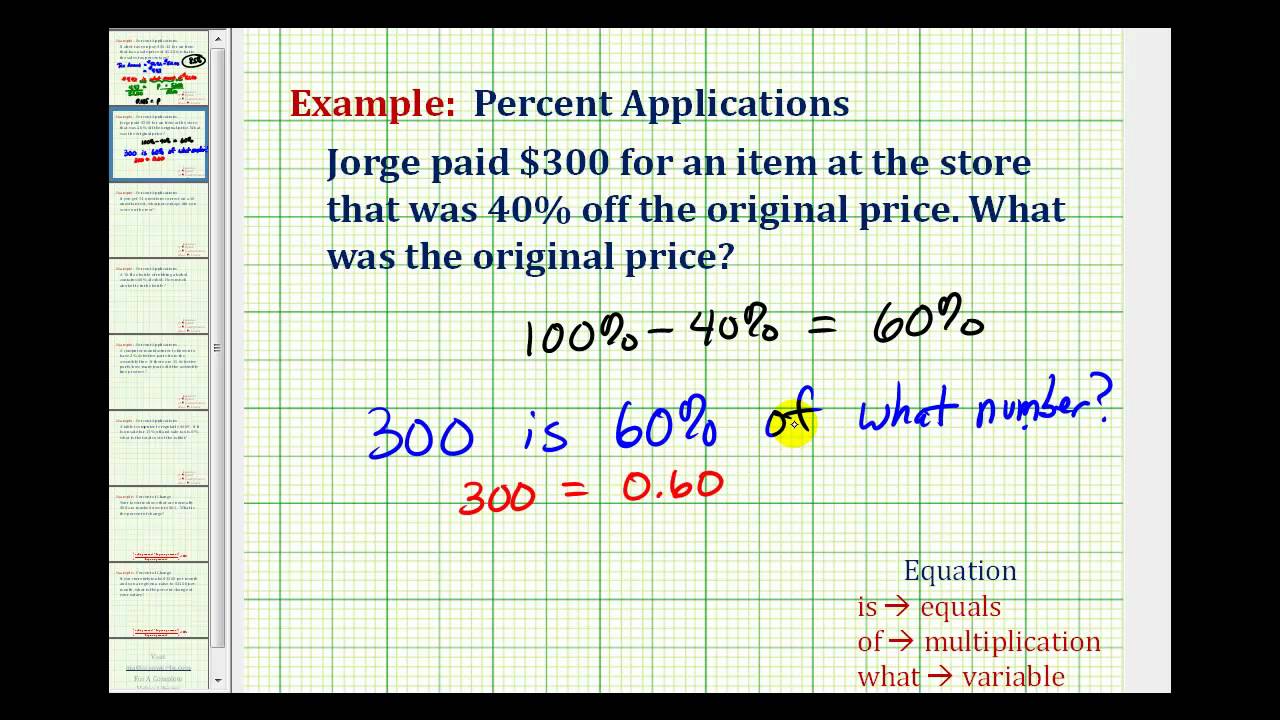

Ex Find The Original Price Given The Discount Price And Percent Off Youtube Percents The Originals Education

Percents Math Activities Tpt Math Common Core State Standards

0 Comments